The Complete Guide to UK Car Tax Rates in 2024

How much road tax – or Vehicle Excise Duty (VED), to give it its formal name – you had to pay used to be a simple business. And once you had paid it you got a disc to display in your windscreen that showed both that your tax was up to date and when it was due to be renewed.

Today, it’s all a bit more complicated. Partly, that’s because everything is done online, so you no longer have to display a tax disc, which in turn means you might have to remember to renew. The other major change happened when the level of road tax you paid became determined by your vehicle’s CO2 emissions, so that some vehicles, including electric ones, didn’t need to pay the tax at all.

If you’re not sure about how much road tax you should be paying in 2024, here’s our simple guide. Please note, however, that you will end up paying a little more than what we have displayed here if you decide to pay monthly by direct debit.

Cars Registered Before 1 March 2001

For cars registered before 1 March 2001, it’s very straightforward to determine how much tax you’ll pay, as it is based solely on engine size.

Cars Registred After 1 March 2001 and Before 1 April 2017

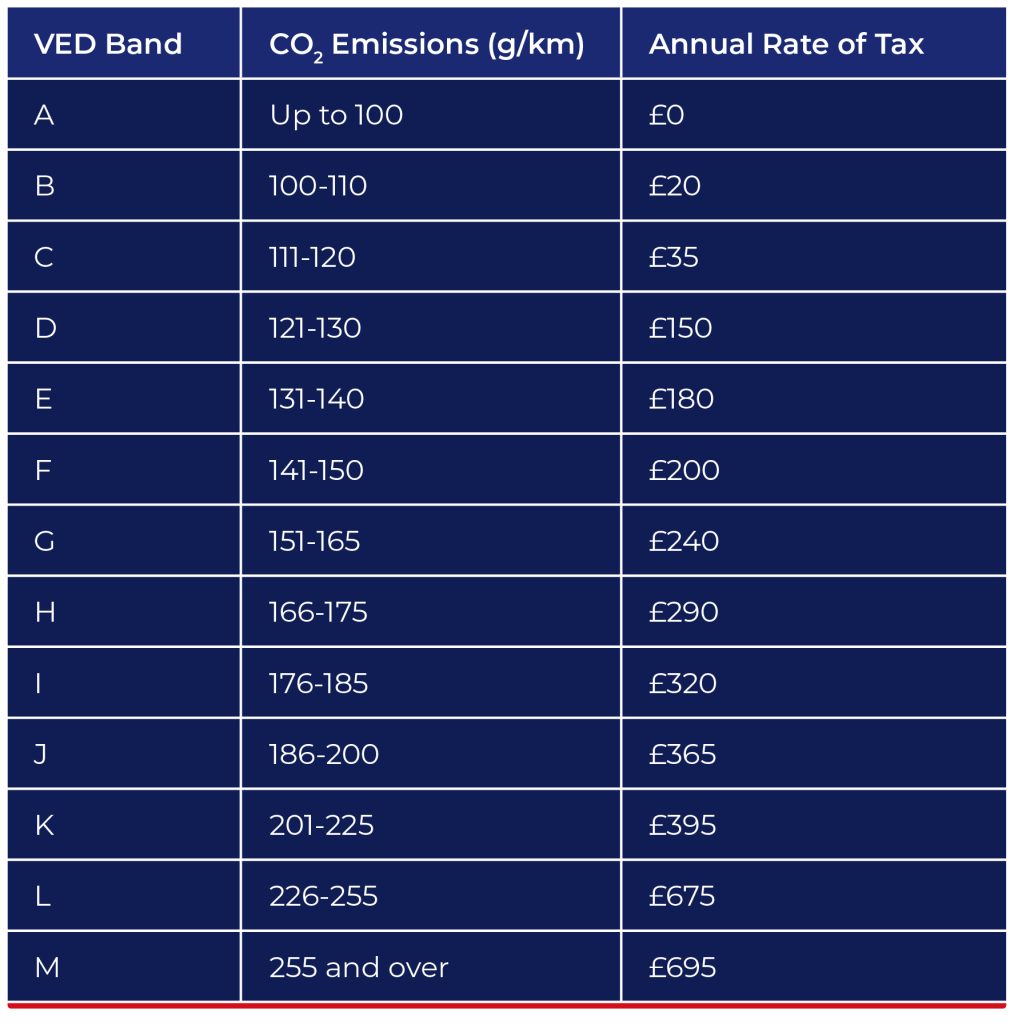

This is where things get a bit more complicated, as vehicles registered after 1 March 2001 and before 1 April 2017 are split into 13 separate categories (known as VED bands), based on CO2 emissions.

Vehicles not entirely fueled by petrol or diesel get a £10 discount on these charges – this applies to hybrids, plug-in hybrids and vehicles using biofuel, LPG or CNG.

Please note that from 1 April 2025, VED Band A will be abolished, with vehicles currently paying no tax being merged with Band B and paying £20.

Cars Registered After 1 April 2017

With new cars putting out fewer and fewer emissions, and tax revenues as a result dropping alarmingly – from the government’s point of view, at least – another new system was introduced in 2017.

From the second year of registration, this separates vehicles into three categories – those with no emissions, vehicles with a list price of over £40,000 (including optional extras) and everything else.

A standard rate of £180 a year applies to all vehicles except those with zero emissions, which are currently exempt, and vehicles that are listed at over £40,000 (including optional extras), which pay an extra £390 a year for the first five years for which the standard rate is applied.

As mentioned, this standard rate applies from the second year of registration onwards only. For the first year, there is a ‘showroom’ tax based on emissions – again, vehicles with zero emissions are currently exempt.

However, vehicles with zero emissions will start paying tax from 1 April 2025, with the next category being amended to 0-50g/km instead of 1-50g/km.

Here at UK Tyres, we’re your local experts for everything to do with cars and other vehicles in North and West London, from tyres and MOTs to servicing and repair.

Determined to offer value, reliability and a fast and friendly service every time, we’re a family-run business that’s been meeting the motoring needs of its customers since the 1940s.

Get in touch now to find out more.